Becoming certified in your accounting software is a green light for business owners. They’ll be more inclined to pay higher fees if they see you’ve been endorsed by well-known software companies, especially if it’s the software that they use for their accounts. Along with considering the above factors when setting your pricing for bookkeeping services, you’ll also want to set up a pricing structure that works for you and your firm. You must understand what bookkeeping services you need and whether it’s best to hire a what is gross profit professional bookkeeper full time, part time, or outsource the service. Many new businesses start out doing basic bookkeeping by themselves.

As a contractor, you’re using all your own equipment, so you’re saving them all of that money. 58% of accountants said updating technology has improved efficiency and productivity, which is vital for creating space to add the services that clients demand. Bundling services together in set packages is a good way to implement fixed-fee pricing.

Fixed-fee pricing allows you to increase profit as you increase efficiency—the more efficiently you can work, the greater the profit margin. The geographical location of your bookkeeper plays a massive role in how expensive the service will be. You also get the benefit of a higher expertise level compared to training your office manager for bookkeeping.

You’ll learn how to price bookkeeping services for profitability in this piece. You should not deliver an upfront fixed price unless your average cost is known. After you understand your client’s needs, you’ll need to define your scope of work before you set your prices. Developing good discovery call questions is key in this step. Spend some multiple streams of income time researching these kinds of questions to properly establish your client’s needs in order to outline the additional services that are required.

Bookkeeping services pricing structure

- Average monthly fees for this type of activity include from $500 to $2,500.

- According to Glassdoor, it costs about $42,000 a year to hire a bookkeeper for your small business.

- Different factors affect the cost of bookkeeping services.

- You are paying for your own computer, your own equipment, and your own office supplies.

- Obviously, if you’re an employee working as an in-house bookkeeper, you can’t offer value pricing.

My goal is to help you understand what these breakdowns look like for each client. The cost can be from a $20 hourly rate for basic services. Ideally, hire part time bookkeepers when you can do some of the accounting yourself, and could use extra help for employee timesheets, accounts payable, and accounts receivable tracking.

Guide to Pricing Accounting Services (Fixed & Value Pricing)

Templates, workflows and automations all give you time back in your day that you can spend building your client base and adding value for existing clients. Price anchoring is a strategy that plays on a buyer’s tendency to inherently compare information. So, when people see your pricing options, one of the things they’ll first notice is that your top-tier option is higher than your mid- and low-tier plans, and they’ll use that as an anchor. In any industry, experience is influential in pricing decisions, and bookkeeping is no different. It means quality of service, efficiency, calmness, problem-solving, and confidence.

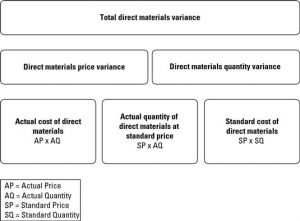

Fixed costs

If you’re not there already, it’s worth upskilling to get to that point, as you’ll be able to justify higher pricing packages. A full charge bookkeeper takes care of the usual bookkeeping service but also handles some accounting duties. Think of this bookkeeping service as a mix between traditional accounting and bookkeeping.

It was so bad that it caused me to scour the internet for a solution and luckily I stumbled across Practice Ignition when the company first started in 2013. In fact, I was actually proudly one of Practice Ignition’s first customers on the platform back in 2013. Once you have arrived at your price for a particular mandate, the next step is to have a mutual agreement in place that documents your understanding of the scope of work and price per month. There is actually no formula for trying to determine what someone is willing to pay per month. The more you establish value in Step 1, the easier your job will be in demanding a higher price per month.

For example, the National Association of Certified Public Bookkeepers (NACPB) offers a QuickBooks Online certification. Xero and other accounting software have their own qualifications which, once earned, show you’re an expert in their product. When you’re calculating your rates, especially in a new location, doing local research is crucial. Ask other bookkeepers about services, rates, and gather any other information about working in your area that will help you stay competitive. Generally, small to medium-sized businesses expect to pay between $500-$2,500 USD monthly for their outsourced bookkeeping—an dauntingly large range to deal with. Consider how frequently you provide services to a client when making up the next child tax credit payment pays out aug 13 your mind about what to charge.

Share your feedback about this course