Again, they are anti-dilutive; if they were added to the diluted share count, loss per share would improve slightly, to $0.95. The diluted share count differs from the basic share count in that it adds shares that aren’t yet issued — but could be. For instance, executives may have stock options that are “in the money”; in other words, it would be profitable to exercise those options and turn them into shares. But basic share count does not account for those options, or for warrants (which function much like options).

What Is the Difference Between Basic EPS and Diluted EPS?

Earnings are ultimately a measure of the money a company makes and are often evaluated in terms of earnings per share (EPS), the most important indicator of a company’s financial health. Earnings reports are released four times per year and are followed very closely by Wall Street. Investors can track the schedule of earnings reports for publically traded companies through their broker, the Nasdaq calendar, and the SEC’s EDGAR system.

Ask a Financial Professional Any Question

When analysts or investors use earnings per share to make decisions, they are usually looking at either basic or diluted earnings per share. The reported earnings per share are calculated using generally accepted accounting principles. The company declares this during its filing with the Stock Exchange Commission. This implies that noncumulative shareholders do not build up over time as cumulative preferred investors pay dividends in arrears. If a shareholder is not paid on time, preferred shares allow for that person to still receive their full dividend payment, including any missed or previous payments. Common shares are types of stocks that show partial ownership in a company.

What Does EPS Tell You?

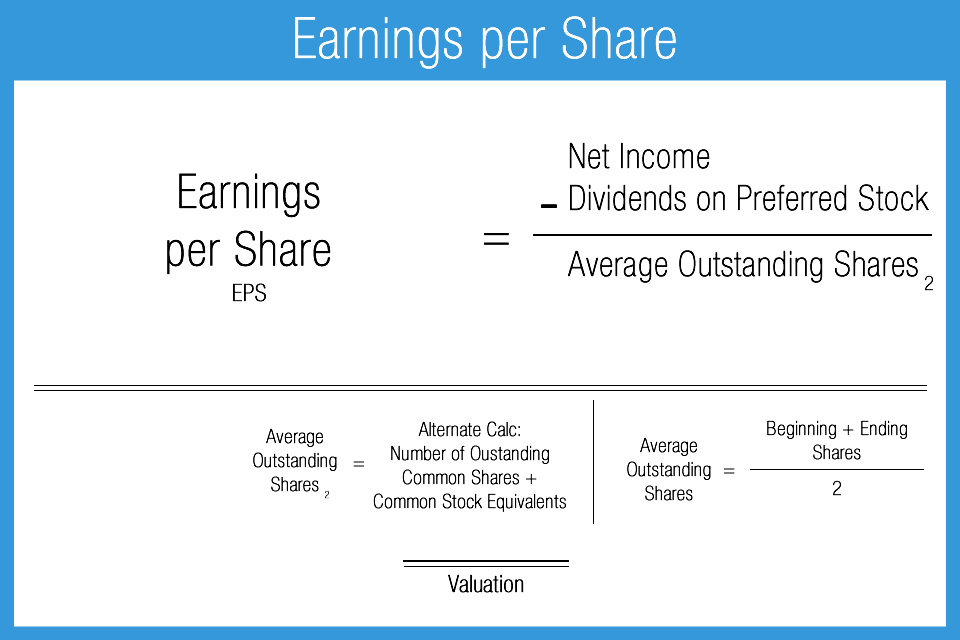

Earnings per share is defined as a company’s total profit divided by the number of shares outstanding. It’s a straightforward way to assess profitability, as it takes the complexities of the income statement and distills it into one simple number. EPS is a simple, efficient way to analyze a company’s growth trends as well as how it compares to its peers.

- If a shareholder is not paid on time, preferred shares allow for that person to still receive their full dividend payment, including any missed or previous payments.

- The core reason is that share counts can be extraordinarily different.

- Annual EPS growth is a company’s EPS over the last year divided by its EPS over the prior year, minus 1.

Thus, the “Net Earnings for Common Equity”—which is calculated by deducting the preferred dividend from net income—amounts to $225 million. For an illustrative, real-life example, the following screenshot below is of the income statement of Apple (AAPL) from its 10-K filing for fiscal year ending 2022. irs says you can amend your taxes electronically, but should you The distinction between the basic and diluted EPS can be seen in the denominator of their respective formula. Ultimately, the company’s allocation of its net earnings is a discretionary decision determined by management and the board of directors, with the goal of maximizing shareholder value.

Understanding Basic Earnings Per Share

To calculate a company’s earnings per share, take a company’s net income and subtract from that preferred dividend. When calculating the quarterly EPS for a company, using the weighted average shares outstanding for the time period may give you a better picture than the shares outstanding on the last day of the quarter. Although many investors don’t pay much attention to the EPS, a higher earnings per share ratio often makes the stock price of a company rise. Since so many things can manipulate this ratio, investors tend to look at it but don’t let it influence their decisions drastically. Earnings per share (EPS) is a company’s net income divided by its outstanding shares of common stock. Net income is the income available to all shareholders after a company’s costs and expenses are accounted for.

Obviously, this calculation is heavily influenced on how many shares are outstanding. Thus, a larger company will have to split its earning amongst many more shares of stock compared to a smaller company. Earnings per share takes into account common stock only; the preferred stock does not influence the value of the shares.

Higher earnings per share is always better than a lower ratio because this means the company is more profitable and the company has more profits to distribute to its shareholders. If you happen to invest in companies on the stock market, you probably own quite a lot of shares. With the use of this earnings-per-share calculator, you will be able to assess their real value in just a few clicks. This tool will teach you how to calculate your earnings per share and provide you with a foolproof EPS formula.

Other financial metrics can also give investors a fuller view of the company and its prospects. The answer to “what is a good EPS” for a particular stock depends on what you’re trying to do — and on the industry that stock operates in. Basic EPS, as the name implies, is the simpler way of calculating EPS, and only uses outstanding shares of common stock in the calculation. Another consideration for basic EPS is its deviation from diluted EPS.

Share your feedback about this course